Is the Housing Market on the Brink of a Crash

Thursday, October 24, 2025

Categories: For Buyers, For Sellers, Home Prices, Economy, Forecasts

If you've caught wind of alarming headlines or viral social media claims predicting a real estate meltdown, it's natural to fret over whether property values are set for a sharp drop. But let's cut through the noise with the facts.

The numbers tell a different story: no signs of a downturn, just gradual, ongoing appreciation.

Of course, outcomes will differ by region—some areas might outpace others in gains, and a few could experience brief, minor dips. Yet the national outlook remains clear: experts foresee home prices trending upward, not downward, across the coming five years.

Unpacking the Projections from Industry Leaders

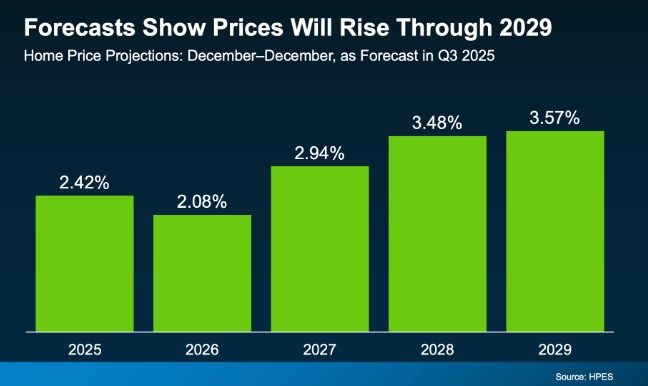

Fannie Mae's quarterly Home Price Expectations Survey (HPES) gathers insights from more than 100 top housing professionals, economists, and academics on future price trajectories. The freshly published Q3 2025 edition shows broad agreement: national home values are slated to increase steadily at least until 2029 (check the chart below):

This chart breaks it down simply: every bar represents positive growth, with the rate of increase fluctuating slightly from year to year.

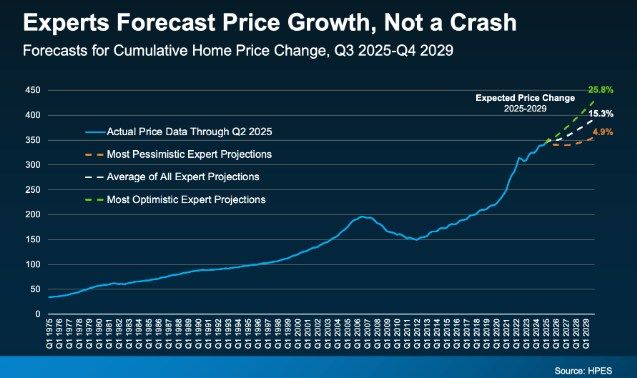

For another angle on current trends and forward-looking estimates, consider this breakdown of the forecasts into three buckets: the consensus average, the rosiest outlooks from the top third of respondents, and the most cautious views from the bottom third (see the chart below):

In summary, the group expects about a 15% national uptick from today through late 2029. Bullish voices project closer to 26%, while the skeptics still expect around 5%. The standout takeaway? Zero forecasts from these market watchers suggest a crash—or even a dip—anytime soon.

Putting These Trends in Historical Perspective

Returning to the initial chart, the anticipated 2-3.5% yearly bumps align with a more measured pace. Historically, over the past quarter-century, annual appreciation has averaged 4-5%.

That's a tad softer than the long-term norm, but far healthier than the blistering surges of 2020-2022, when low inventory and surging buyer interest drove some locales to 15-20% jumps in a single year.

What might seem like a slowdown after those boom times is actually the market recalibrating to a healthier equilibrium.

Reasons a Price Plunge Isn't on the Horizon

Much of the current buzz around falling values stems from that post-pandemic rebound and the adage that rapid ascents inevitably lead to tumbles. Yet history shows otherwise—residential prices have trended up consistently over decades.

The key differentiator from the 2008 crisis? Fundamentals like inventory and buyer interest.

Despite affordability strains sidelining some would-be purchasers in recent years, demand still outstrips supply nationwide. This persistent imbalance continues to buoy prices.

That's the bedrock of the unanimous expert view: anticipate reliable, enduring growth, not a freefall.

And if broader economic jitters are fueling your concerns, take heart. The last half-century has weathered recessions, booms, and busts, yet housing has invariably bounced back. We're navigating that rebound now, emerging stronger.

Key Takeaway

If crash fears have kept you on the sidelines as a buyer or seller, shift your focus from sensational stories to solid stats.

The real debate isn't whether values will climb—it's the extent of the rise.

Reach out today to discuss local dynamics and how these national trends could shape your real estate plans.

Categories

Recent Posts

GET MORE INFORMATION