First-Time Home Buyer Loans and Programs in Los Angeles

First-Time Home Buyer Loans and Programs in Los Angeles: Your Complete Guide

Breaking Down Barriers to Los Angeles Homeownership

For first-time home buyers in Los Angeles, navigating the complex landscape of home loans and assistance programs can feel overwhelming. With median home prices reaching $850,270, understanding available financing options and first-time buyer programs is essential for achieving homeownership in one of America's most desirable markets.

Understanding First-Time Home Buyer Status

In California, you're considered a first-time home buyer if you haven't owned and occupied a home in the past three years. This definition opens doors to numerous assistance programs and favorable loan terms specifically designed to help new buyers enter the market.

Federal Loan Programs for First-Time Buyers

FHA Loans: The Popular Choice

Federal Housing Administration (FHA) loans remain the most accessible option for first-time home buyers, requiring down payments as low as 3.5%. These government-backed loans accommodate buyers with credit scores as low as 580 and offer more flexible qualification requirements than conventional mortgages.

FHA loans require mortgage insurance premiums, but the benefits often outweigh these costs for first-time buyers. The program allows gift funds for down payments and closing costs, making homeownership more accessible for buyers with limited savings.

VA Loans: Zero Down for Veterans

Veterans, active-duty service members, and eligible spouses can access VA loans with zero down payment requirements. These loans don't require mortgage insurance and often feature competitive interest rates, making them exceptionally valuable for qualified borrowers.

USDA Loans: Rural Area Opportunities

While Los Angeles County is primarily urban, some outlying areas qualify for USDA loans offering zero down payment options for moderate-income buyers in designated rural areas. These loans target specific geographic areas and income levels.

California State Programs

CalHFA Loan Programs

The California Housing Finance Agency offers comprehensive first-time buyer assistance through multiple programs. CalHFA provides 30-year fixed-rate loans with competitive interest rates and down payment assistance options.

Key CalHFA programs include:

-

MyHome Assistance Program: Provides deferred-payment loans for down payments and closing costs

-

CalPLUS Programs: Combine first mortgages with zero-interest loans for closing costs

-

CalHFA Zero Interest Program (ZIP): Offers closing cost assistance with no monthly payments

Income and Credit Requirements

CalHFA programs typically require minimum credit scores of 660-680, depending on the loan type. Income limits vary by county and household size, with some areas allowing incomes up to $300,000.

Local Los Angeles Programs

Los Angeles First-Time Home Mortgage Program

The city of Los Angeles offers assistance up to 4% of the total mortgage amount for down payment and closing cost assistance. This assistance comes as a grant with no repayment requirements, making it particularly attractive for qualified buyers.

County Programs

Various Los Angeles County municipalities offer additional first-time buyer assistance, including down payment grants and favorable loan terms. These programs often target specific income levels and geographic areas within the county.

Understanding Down Payment Requirements

Minimum Down Payment Options

First-time buyers in Los Angeles have several low down payment options:

-

FHA loans: 3.5% minimum

-

Conventional loans: 3% minimum with some programs

-

VA loans: 0% for qualified veterans

-

USDA loans: 0% in eligible areas

Down Payment Assistance Programs

Multiple programs help first-time buyers overcome down payment barriers. These include grants, deferred loans, and employer assistance programs that can significantly reduce upfront costs.

The Pre-Approval Process

Gathering Required Documentation

Successful pre-approval requires organizing financial documents including tax returns, pay stubs, bank statements, and employment verification. Having these documents ready accelerates the approval process.

Credit Score Optimization

Before applying for loans, review your credit report and address any inaccuracies. Paying down existing debts and avoiding new credit applications during the home buying process helps maintain optimal credit scores.

Shopping for Lenders

Different lenders offer varying terms and programs. Compare interest rates, fees, and program options from multiple sources including banks, credit unions, and mortgage brokers.

Calculating Affordability

Total Cost Considerations

Beyond mortgage payments, factor in property taxes, insurance, HOA fees, and maintenance costs. Los Angeles properties often include significant tax obligations and insurance requirements that affect overall affordability.

Debt-to-Income Ratios

Most programs require debt-to-income ratios below 43%, though some allow higher ratios with compensating factors. Calculate your total monthly debt obligations against gross monthly income to understand your borrowing capacity.

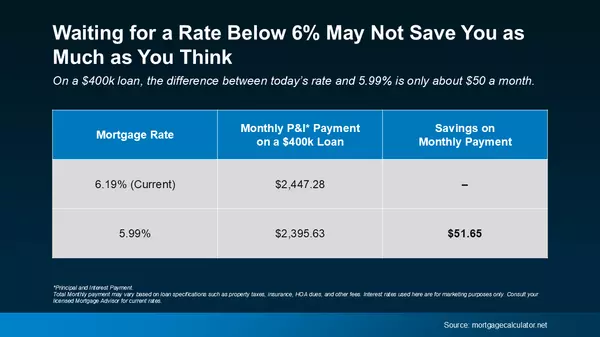

Interest Rate Considerations

Current mortgage rates in Los Angeles averaged 6.73% in 2024, remaining elevated despite Federal Reserve rate cuts. First-time buyer programs often offer competitive rates, but shopping among multiple lenders ensures optimal terms.

Closing Costs and Additional Expenses

Typical Closing Costs

Expect closing costs between 3-6% of the purchase price. In Los Angeles, this translates to $25,000-$50,000 on a median-priced home, making closing cost assistance programs particularly valuable.

Additional First-Year Expenses

Budget for moving costs, immediate repairs, furnishing, and potential HOA fees that aren't included in mortgage payments. These expenses can add $5,000-$15,000 to your first-year homeownership costs.

Common First-Time Buyer Mistakes

Overextending Financially

Avoid borrowing the maximum amount lenders approve. Leave room in your budget for unexpected expenses and lifestyle changes.

Skipping Professional Inspections

Never waive home inspections, even in competitive markets. Professional inspections can identify costly problems before purchase.

Inadequate Emergency Funds

Maintain emergency savings equivalent to 3-6 months of housing expenses after closing. Homeownership includes unexpected repair and maintenance costs.

Market-Specific Considerations for Los Angeles

Competitive Market Strategies

Los Angeles's competitive market often features multiple offers on desirable properties. Strengthen your position by:

-

Obtaining pre-approval letters

-

Working with experienced local agents

-

Being prepared to move quickly

-

Understanding market values to make competitive offers

Geographic Variations

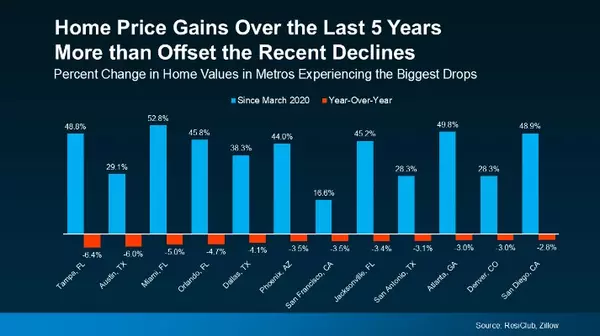

Los Angeles County encompasses diverse markets with varying prices and appreciation potential. Research specific neighborhoods and consider future development plans that might affect property values.

Building Your Real Estate Team

Choosing the Right Agent

Select agents with extensive Los Angeles market experience and strong track records with first-time buyers. Look for professionals who understand available programs and can guide you through complex transactions.

Lender Selection

Work with lenders experienced in first-time buyer programs and California regulations. Some lenders specialize in specific programs and may offer better terms or faster processing.

Long-Term Financial Planning

Building Equity

Los Angeles's historical appreciation makes homeownership an effective wealth-building strategy. Even modest appreciation compounds significantly over time.

Tax Benefits

Homeownership provides tax advantages including mortgage interest deductions and property tax deductions. Consult tax professionals to understand your specific benefits.

Program Application Timeline

Starting the Process

Begin researching programs and gathering documentation 3-6 months before intended purchase. This timeline allows adequate preparation and program enrollment.

Application Processing

Most programs require 30-60 days for approval and funding. Plan accordingly to avoid delays during property purchase.

**Ready to Start Your First-Time Buyer Journey?**

Navigating first-time buyer programs and loans in Los Angeles requires expertise and local knowledge. Our team specializes in helping first-time buyers access available programs, secure favorable financing, and successfully purchase their first homes in Los Angeles's competitive market.

Contact us today for a comprehensive consultation about first-time buyer programs and financing options. We'll evaluate your financial situation, identify applicable programs, and connect you with preferred lenders who understand Los Angeles market dynamics.

Don't let financing concerns prevent you from achieving Los Angeles homeownership. Call us now to schedule your free first-time buyer consultation and discover how we can help you access the programs and resources needed for successful home purchase.

Categories

Recent Posts

GET MORE INFORMATION