When an ARM Might Be a Good Idea

Using an Adjustable-Rate Mortgage (ARM) can be a good idea for specific buyers and financial situations, primarily if you plan to sell or refinance before the initial fixed-rate period ends. However, it is riskier than a fixed-rate mortgage due to potential payment increases when the rate adjusts.

When an ARM Might Be a Good Idea

- Short-term ownership: If you plan to move, sell, or pay off the mortgage within the initial fixed-rate period (e.g., 5, 7, or 10 years), you can take advantage of the lower introductory rate and avoid the uncertainty of future adjustments.

- Plans to refinance: If you anticipate that interest rates will drop in the future and plan to refinance into a fixed-rate mortgage before your ARM adjusts, an ARM can offer short-term savings.

- Expected income increase: If you are early in your career and expect your income to increase significantly in the coming years, you might be more comfortable with the risk of potentially higher payments later on.

- Comfort with risk: ARMs are suitable for borrowers who are comfortable with some level of market risk and payment variability in exchange for initial savings.

- Higher initial buying power: The lower initial monthly payment can help you qualify for a more expensive home or free up cash flow for other investments or home improvements in the short term.

- Potential for significantly higher payments: The biggest risk is that after the initial fixed period ends, your interest rate and monthly payment could increase, potentially making the mortgage unaffordable if market rates have risen.

- Budget uncertainty: The fluctuating payments can make long-term budgeting and financial planning difficult.

- Refinancing challenges: There is no guarantee you will be able to refinance when the fixed-rate period ends. Rising interest rates or a change in your financial situation could prevent you from securing a favorable fixed-rate loan.

- Less long-term predictability: Unlike a fixed-rate mortgage which offers stability for the life of the loan, an ARM introduces variability into your long-term housing costs.

- Prepayment penalties: Some ARMs may have penalties if you pay off the loan or refinance too early, so it is important to check the terms carefully.

Ultimately, choosing an ARM requires a careful assessment of your personal finances, risk tolerance, and long-term homeownership goals. Consulting with a qualified financial advisor or a loan officer can help you determine the best option for your specific situation.

Reference materials:

Categories

Recent Posts

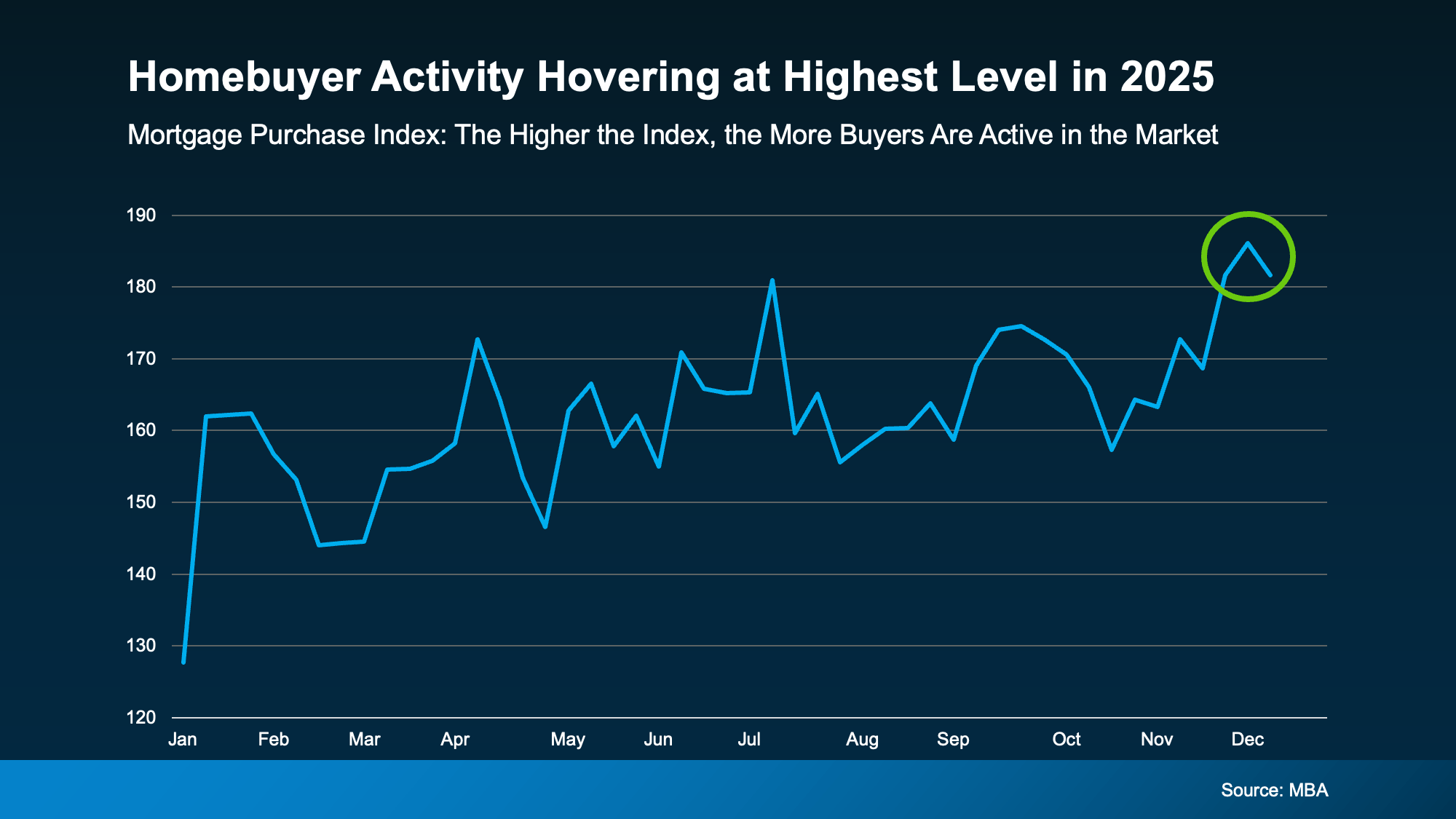

Is Buyer Demand Picking Back Up?

Southern California Today – An Overview (With Expanded Focus on Los Angeles)

Year-End Home Checklist: Prep Your House & Plan Your Purchase

The Importance of Professional Real Estate Photography

Pricing Strategy: List High, Price Low, or Price Right?

Should I Disclose Past Water Damage in California?

5 Red Flags That Turn Buyers Off Instantly (And How to Fix Them)

5 Things Buyers Should Never Say to a Seller (Negotiation Killers)

What is the Loan Limit in LA County? (Conforming vs. Jumbo Loans)

7 Critical Questions to Ask Your HOA Before Buying a Condo

GET MORE INFORMATION